What is EarnIn?

EarnIn is a financial service platform designed to help individuals access small cash advances, manage their budgets, and avoid overdraft fees. The platform is committed to providing fast, user-friendly, and transparent financial solutions for users in need of immediate funds.

Features of EarnIn

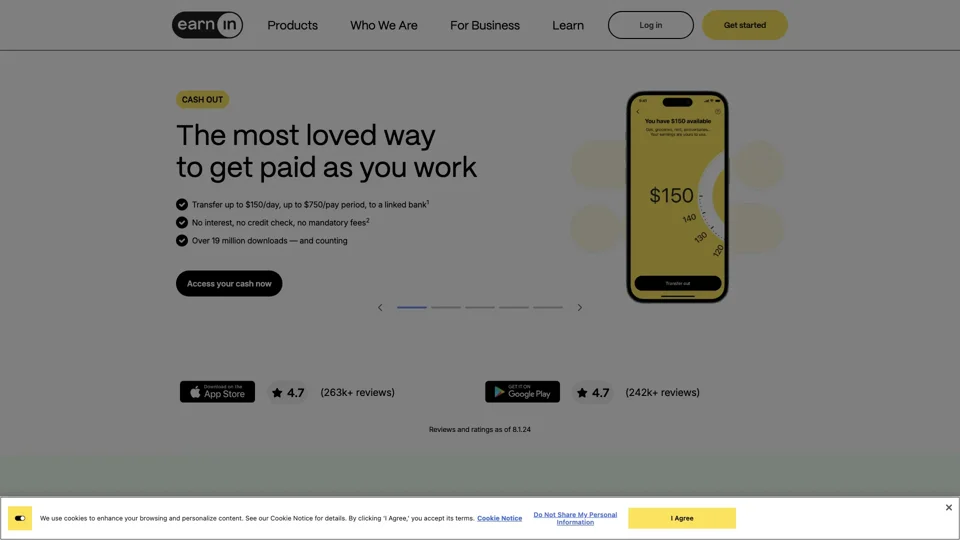

Cash Out

Access up to $150/day, up to $750/pay period, to a linked bank account with no interest, no credit check, and no mandatory fees.

Early Pay

Get your paycheck up to 2 days early in your bank account with no need to switch banks.

Balance Shield

Help avoid overdraft fees and low balances with real-time notifications and optional auto-transfers of $100.

Credit Monitoring

Track your Vantage Score 3.0 by Experian for free and stay on top of your credit goals.

Tip Yourself

Effortlessly save with every paycheck with no-cost, FDIC-insured transfers.

How to use EarnIn?

Download the EarnIn app and create an account. Link your bank account to enable financial tracking and cash advance requests. Request a cash advance when needed, with funds typically deposited within minutes (or up to a day, depending on transfer speed). Use additional tools such as budgeting features, alerts, or gig-finding resources to support your financial goals.

Are there fees for using EarnIn?

EarnIn does not charge interest on cash advances nor does it charge mandatory fees for regular transfers (typically 1-2 business days). You can pay an optional Lightning Speed fee to get your money within 30 minutes. Restrictions may apply.

Do I need a credit check to use EarnIn?

No, EarnIn does not require credit checks for its cash advance services, making it accessible to users with limited or no credit history.

How can I maximize my use of EarnIn?

Use the budgeting tools to monitor spending and stay on top of your finances. Set up alerts to avoid overdraft situations. Explore gig opportunities to increase your income. Request cash advances responsibly and only when necessary to avoid dependency.

Will my data be used or shared?

EarnIn values user privacy and ensures your data is securely managed. Personal information is used only to provide services, and you have the option to delete your account and all associated data at any time.

When would I need a subscription to EarnIn?

A subscription is recommended for users who want access to EarnIn's budgeting tools and side hustle features, need regular access to small cash advances to avoid overdraft fees, or prefer the convenience of having all financial management tools in one app.

Why choose EarnIn?

EarnIn stands out for its transparent, affordable, and user-friendly approach to financial management. By combining cash advances, budgeting tools, and gig opportunities, EarnIn empowers users to take control of their financial health and avoid unnecessary fees.

Frequently Asked Questions

Is EarnIn legit?

EarnIn runs on optional tips — not unnecessary fees. Simply add what you think is fair (even $0) when you transfer money out.

How secure is EarnIn?

We use the latest in security technology to keep your data protected. And we never sell your personal information. Period.

How do I get in touch?

Questions? We're here for you 24/7. Chat with your EarnIn Care Team directly in the app.