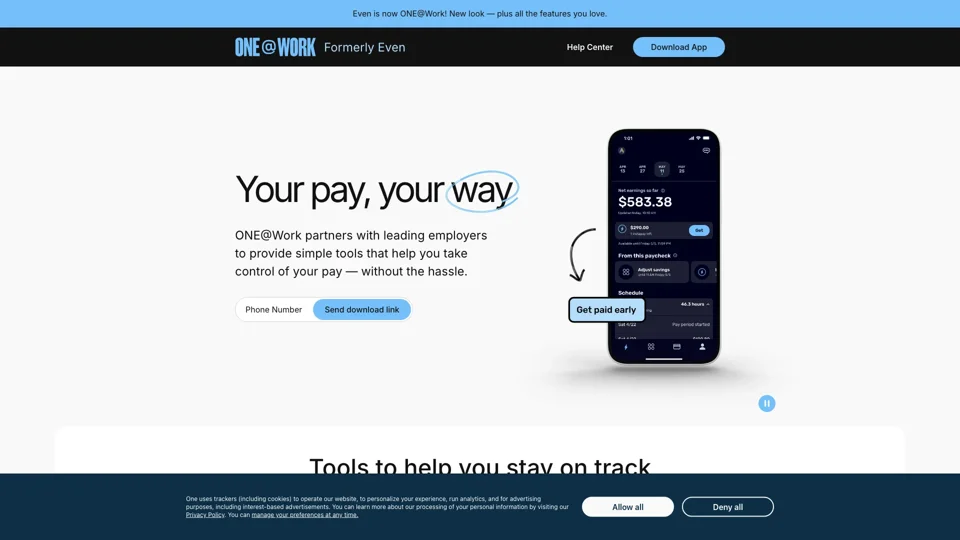

What is ONE@Work?

ONE@Work is a financial app that helps you take control of your pay so you can stress less about your finances. We partner with leading employers to offer the app as an employee benefit.

Features of ONE@Work

Get Paid Early

Get part of your paycheck early with Instapay, so you have your money when you need it most. No loans or hidden interest.

Save Automatically

Choose a percentage you want to save and we'll deduct it from your paycheck automatically. Pause, adjust, or withdraw any time.

Budget Easily

Connect your bank account and ONE@Work automatically detects your monthly expenses and helps you calculate what's okay to spend.

Track Your Earnings

See your schedule and track how much you'll make per shift and per paycheck – no more guesswork.

Fees for Using ONE@Work

No, ONE@Work is a free employee benefit. You can get your Instapay in seconds, for free, if your employer has configured this benefit in the app. If they have not, a small fee will apply for instant deposits. All other Instapay delivery options are free.

Credit Check for ONE@Work

No, ONE@Work does not require a credit check to use its services.

Subscription for ONE@Work

No subscription is required to use ONE@Work. It's a free employee benefit.

Helpful Tips for Using ONE@Work

- Use Instapay to get paid early and avoid financial stress.

- Save automatically to build up your savings.

- Budget easily by tracking your expenses and income.

- Track your earnings to stay on top of your finances.

Frequently Asked Questions

Who can use ONE@Work?

The app is available to members who are currently employed at a company that offers the app as a benefit.

Why should I use ONE@Work?

ONE@Work gives you simple tools to help you take control of your pay. With ONE@Work, you can get paid early to help cover the unexpected, save for the future, and budget with confidence.

Do I need to bank through ONE to use ONE@Work?

No, banking through ONE is not required to use ONE@Work. But you get more ONE@Work perks when you bank through ONE.