What is Cash Advance?

Cash Advance is a financial service that allows individuals to access small amounts of money quickly, often to cover unexpected expenses or to avoid overdraft fees. This service is usually provided by financial institutions, fintech companies, or online lenders.

Features

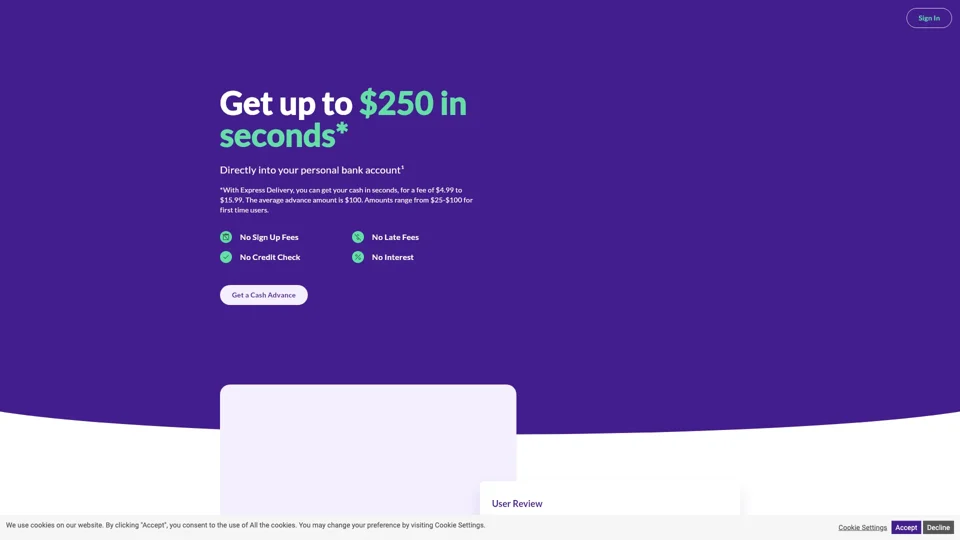

- Quick access to cash: Get the money you need in a short amount of time, often within minutes or hours.

- No interest or credit checks: Many cash advance services do not require credit checks or charge interest on the borrowed amount.

- Flexible repayment: Repayment terms may vary, but some services allow you to repay the amount borrowed in installments or all at once.

Fees

- Some cash advance services may charge a small fee for the transaction, which can vary depending on the provider.

- Expedited transfer fees: If you need the money quickly, you may be charged an additional fee for expedited transfer.

Credit Check

- No credit check required: Many cash advance services do not perform credit checks, making it accessible to individuals with limited or no credit history.

Subscription

- Some cash advance services may offer a subscription-based model, which can provide additional benefits such as access to budgeting tools, gig opportunities, or financial education.

Helpful Tips

- Use cash advances responsibly: Only borrow what you need and can repay to avoid dependency.

- Monitor your spending: Keep track of your expenses to avoid overspending and stay on top of your finances.

- Explore alternative options: Consider other financial options, such as budgeting apps or savings accounts, to manage your finances.

Frequently Asked Questions

- What is the maximum amount I can borrow?

- The maximum amount varies depending on the provider and your financial situation.

- How long does it take to get the money?

- The transfer time can vary from minutes to a day, depending on the provider and transfer speed.

- Is my data secure?

- Reputable cash advance services prioritize user privacy and ensure your data is securely managed.